ATTRACTING BUSINESSES AND TALENTS

Trade

With Hong Kong

Setting up

a Business in Hong Kong

Strategically located at the heart of Asia and with excellent connectivity, Hong Kong is a regional hub for trading and logistics, which account for 23.7% of its GDP (2022). Hong Kong ranked 6th among leading world traders in 2021, in value of US$ 670 billion, accounting for a 3% share in world trade (WTO's World Trade Statistical Review 2022).

A free port, Hong Kong does not levy any Customs tariff on imports or exports.

It is a separate customs territory and participates in the World Trade Organization as a full and separate member, using the name “Hong Kong, China”. Both English and Chinese are official languages.

More than 98% of companies in Hong Kong are Small and Medium-size Enterprises (SMEs). Most are in the import/export trade and wholesale industries, followed by the professional and business services industry.

Merchandise Trade

In 2022, bilateral merchandise trade between Hong Kong and the EU amounted to US$67 billion.

Taken as a single entity, the European Union was Hong Kong’s 3rd largest trading partner in merchandise trade in the world in 2022. In turn, Hong Kong ranked 35th among the EU’s trading partners in the world and 11th in Asia.

Hong Kong’s top three merchandise trading partners among EU Member States in 2022 were Germany, The Netherlands and France.

Of the total merchandise trade between the EU and the Mainland of China in 2022, around 4.8% (US$43.3 billion) was routed through Hong Kong.

Trade in Services

In 2021, the EU taken as a single entity was Hong Kong's 3rd largest trading partner in the world, with the total services trade between Hong Kong and the EU amounting to US$15 billion, up 23% over 2020.

Business matching services

The Hong Kong Trade Development Council (HKTDC) is a statutory body established to promote and develop Hong Kong’s trade. It organises international exhibitions, conferences and business missions to create business opportunities for companies, particularly SMEs, in the mainland and international markets.

The HKTDC provides business-matching services and can help you find goods, services and business partners in Hong Kong. Contact one of its 11 offices around Europe

Mainland and Hong Kong Closer Economic Partnership Arrangement (CEPA)

CEPA is the first free trade agreement ever concluded by the Mainland of China and Hong Kong. The main text of CEPA was signed on 29 June 2003.

CEPA opens up huge markets for Hong Kong goods and services, greatly enhancing the already close economic cooperation and integration between the Mainland and Hong Kong. Foreign companies established in Hong Kong can benefit from CEPA under the same conditions as Hong Kong companies.

CEPA adopts a building block approach, and the two sides have been working closely to introduce further liberalisation measures continually. The Agreement Concerning Amendment to the CEPA Agreement on Trade in Services implemented from 1 June 2020 introduces new liberalisation measures in a number of important service sectors. (See the video)

Foreign Direct Investment (FDI) flows to Hong Kong grew by 4% to US$141 billion in 2021, making it the second highest recipient of FDI in Asia after mainland China, according to the United Nations Conference on Trade and Development (UNCTAD)'s World Investment Report 2022. Overall, mainland China ranked second in the world for FDI, and Hong Kong third, outranked only by the US.

Hong Kong’s reputation as one of the world’s most competitive economies is well established. The International Institute for Management Development (IMD) World Competitive Yearbook 2022 ranked Hong Kong 5th out of 63 economies.

Our advantages include a government supportive of business, a low, simple and competitive tax system, a multicultural talent pool, an open business environment and world class infrastructure, as well as strong intellectual property protection and Asia’s leading legal and dispute resolution services.

The total number of business operations in Hong Kong with parent companies overseas or in the Mainland was 8 978 in 2022 (1 411 operating as regional headquarters, 2 397 as regional offices and 5 170 as local offices).

The start-up community is highly international, with 25% of founders coming from outside Hong Kong, including 6.8% from France, 2.6% from Germany and 2.3% from Italy. Hong Kong remains attractive to the startups in a diverse range of industries. The “Fintech” sector retained its top spot, followed by “E-commerce/ supply chain management/ logistics technology”. The pandemic catalysed the popularity of specific sectors, which led to a healthy increase in the number of startups under “Education & learning”, “BioTech” and “Health & medical”. (InvestHK’s 2022 Startup Survey).

Setting up a business in Hong Kong is quick and simple

Every investor has a wide range of business vehicles to choose from when doing business in Hong Kong.

Invest Hong Kong (InvestHK) provides free, tailored and comprehensive inward investment support services for overseas enterprises, to help them establish or develop their presence in Hong Kong.

As your first port of call, please contact the Invest Hong Kong team in the Hong Kong Economic and Trade Office in this office, which stands ready to help:

Ms Paula KANT

Head Investment Promotion

Tel: (+32) (0)2 775 00 62

e-mail: paula_kant@hongkong-eu.org

Mr Fernando de la CAL

Deputy Head Investment Promotion

Tel: (+ 32) (0)2 775 00 77

e-mail: fernando_delacal@hongkong-eu.org

Ms Roxana MARICUTU

Senior Manager Investment Promotion

Tel: +32 (0)2 775 00 68

e-mail: Roxana_Maricutu@hongkong-eu.org

Ms Zipo LAI

Head of Family Office Europe

Tel: (+32)(0)2 775 00 75

e-mail: zipo_lai@hongkong-eu.org

Ms Marleen WALRAVENS

Investment Promotion Assistant

Tel: (+32) (0)2 775 00 76

e-mail: marleen_walravens@hongkong-eu.org

You may also contact our colleagues in other parts of the world

Belt & Road Initiative

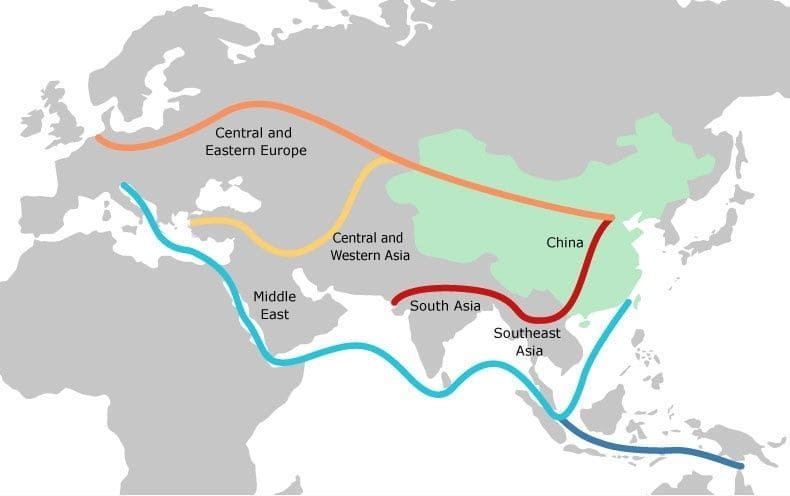

The Belt and Road Initiative refers to the Silk Road Economic Belt and 21st Century Maritime Silk Road, an important national development strategy launched by China.

Its aim is to promote economic co-operation among countries and regions along the Belt and Road routes, where over 4.4 billion people live, accounting for 30% of global economic value.

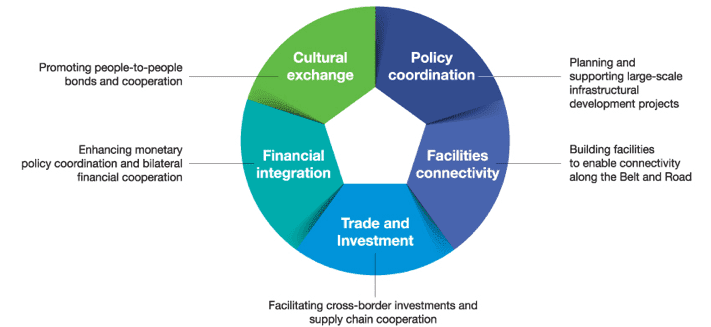

Hong Kong is a key link and the prime platform for the Belt and Road Initiative. With the Central Government’s support, Hong Kong is able to capitalise on its unique advantages, including its position as a leading global capital-raising centre and offshore Renminbi hub, as well as its excellent professional services, to connect the Mainland with other Belt and Road regions.

Hong Kong is participating in six key areas: international project financing and investment; infrastructure and maritime services; economic and trade facilitation; people-to-people bonds; taking forward the Guangdong-Hong Kong-Macao Greater Bay Area Development; and enhancing collaboration in project interfacing and dispute resolution services.

The Belt and Road Initiative offers global businesses - from multinationals to small- and medium-sized enterprises - unparalleled opportunities to tap into new markets along the Belt and Road and gain deeper access to markets in the Mainland China, ASEAN, the Middle East, and Central and Eastern Europe. For developing and emerging economies in these areas, investment and trade accelerate development for the benefit of all.

Knowledgeable, experienced and well-connected, Hong Kong has a unique combination of advantages to partner with investors, intermediaries and project owners worldwide to take advantage of Belt and Road opportunities.

Guangdong - Hong Kong - Macao Bay Area Development

Listen to four leaders in different fields talk about Greater Bay Area Development and how Hong Kong’s unique advantages are helping enterprises and talents leverage the development opportunities of the Greater Bay Area.

- Dr Allan Zeman, Chairman of Lan Kwai Fong Group

- Dr Sunny Chai, Chairman of Hong Kong Science and Technology Parks Corporation

- Mr Fred Lam Tin Fuk, Chief Executive Officer of Airport Authority Hong Kong

- Mr Peter Wong Tung Shun, Chairman, The Hongkong and Shanghai Banking Corporation Limited

Video: 5'29'' version

Video: 15-second version

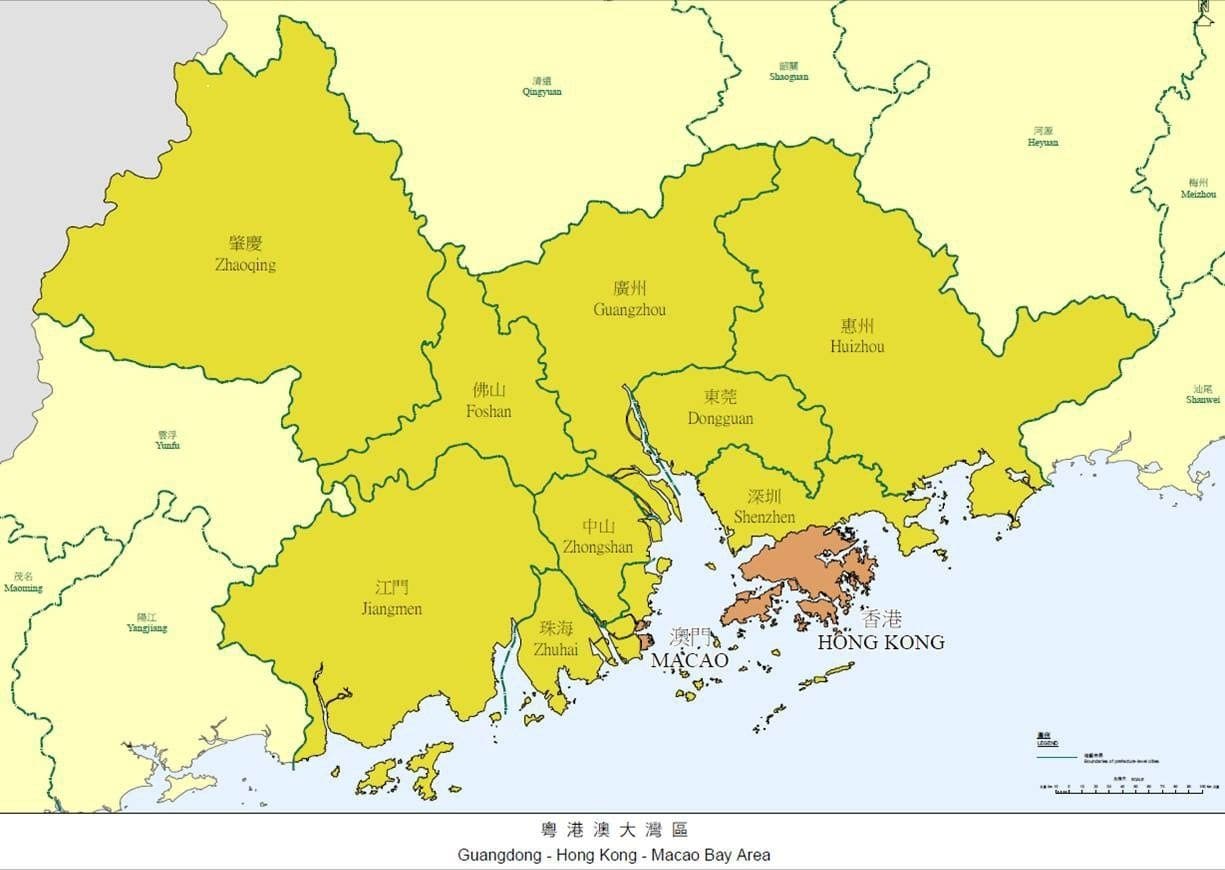

The Guangdong-Hong Kong-Macao Greater Bay Area (Greater Bay Area) is a vibrant city cluster with a population of over 86 million and a combined GDP of nearly US$ 2 trillion. The GBA comprises the Special Administrative Regions of Hong Kong and Macao, and nine cities in Guangdong Province (9+2). Its development potential is enormous.

The development of the GBA will fully make use of the composite advantages of the three places. It will facilitate in-depth integration within the region, and promote coordinated regional economic development, with a view to growing into an international first-class bay area ideal for living, working and travelling.

At 56 000 sq km, the GBA is larger in size than other world class bay areas such as the San Francisco Bay Area (18,000 sq km) and the Tokyo Bay Area (36,500 sq km).

The GBA has all it takes to become the international innovation and technology hub of China. The deepening collaboration among the cities in the GBA will enable them to leverage the synergies of the financial and professional services of Hong Kong, the vibrant tech business sector in Shenzhen, as well as the advanced manufacturing in other cities in Guangdong Province to make it the “Silicon Valley” of the region.

With direct links by road, rail and air, Hong Kong is ideally placed to play a significant role in GBA development, which will further enhance its status as an international hub for finance, logistics, trade and aviation. Hong Kong is also uniquely positioned to be a facilitator and a beneficiary of other important national development strategies such as the Belt and Road Initiative.

Attract Strategic Enterprises

Trawl for Talents

DEDICATED TEAM FOR ATTRACTING BUSINESSES AND TALENTS

Hong Kong is one of the most competitive economies in the world. It also serves as an important gateway connecting the Mainland with global markets. To enhance our competitiveness, the Hong Kong Special Administrative Government puts in place new institutional setups and implements an array of new initiatives targeted at attracting enterprises and investment and talents. We have:

(a) established the Office for Attracting Strategic Enterprises (“OASES”) for attracting strategic enterprises from the Mainland and overseas by offering them special facilitation measures and one-stop services.

The OASES is tasked with attracting high-potential and representative strategic enterprises from around the globe, particularly those from industries of strategic importance, such as life and health technology, artificial intelligence and data science, financial technology (Fintech), and advanced manufacturing and new energy technology. The office will:-

(i) draw up a list of target enterprises and provide steer to the Dedicated Teams for Attracting Businesses and Talents to reach out to and carry out negotiations with the enterprises;

(ii) formulate attractive special facilitation measures covering aspects such as land, tax and financing that are applicable exclusively to target enterprises, and provide them with tailor-made plans to facilitate the setting up of their operations in Hong Kong; and

(iii) provide the employees of these target enterprises with one-stop facilitation services in areas such as visa application and education arrangement for their children.

(b) set aside HK$30 billion (EUR 3.65 billion) to establish the Co-Investment Fund for attracting enterprises to set up operations in Hong Kong and investing in their business.

With the establishment of the Co-Investment Fund, the Government will consider co-investing in individual projects of the target enterprises, taking into account their potential to drive industry development in Hong Kong.

Hong Kong is one of the most competitive economies in the world. It also serves as an important gateway connecting the Mainland with global markets. To enhance our competitiveness, the Hong Kong Special Administrative Government puts in place new institutional setups and implements an array of new initiatives targeted at attracting talents. We have:-

(a) established the Talents Service Unit ("TSU") for formulating strategies to recruit talents from the Mainland and overseas and co-ordinating relevant work, as well as providing one-stop support for incoming talents

The TSU online platform provides one-stop electronic services for talents from around the world. Users may browse all kinds of practical information, including Hong Kong's advantages and development opportunities, details of the various talent admission schemes, as well as information on the necessities of living in Hong Kong. Applicants may use the online platform's Talent Admission Scheme Matching Tool to find out the schemes they are eligible for, and submit applications online.

(b) launched the Top Talent Pass Scheme to widely entice talents to pursue their careers in Hong Kong

Eligible talents will include (i) individuals whose annual salary reached HK$2.5 million or above in the past year, and (ii) individuals graduated from the world's top 100 universities with at least three years of work experience over the past five years. These two categories of talents will be issued a two-year pass for exploring opportunities in Hong Kong and are not subject to any quota. Individuals who graduated from the world's top 100 universities in the past five years and have yet to fulfill the work experience requirement will also be eligible, subject to an annual quota of 10 000.

(c) enhanced existing talent admission schemes to better attract talents

(i) streamlining the General Employment Policy and the Admission Scheme for Mainland Talents and Professionals, such that for vacancies falling under the professions as listed in the Talent List or for vacancies with annual salary of HK$2 million or above, employers are not required to provide proof to substantiate their difficulties in local recruitment in making applications for talent admission

(ii) suspending the annual quota under the Quality Migrant Admission Scheme for a period of two years, and improve the approval process to attract more world-class talents to relocate to Hong Kong

(iii) relaxing the Immigration Arrangements for Non-local Graduates by extending the limit of stay from one year to two years to facilitate their staying in or coming to Hong Kong for work; and expand the scope of the arrangements to cover those who graduated from the Greater-Bay-Area campus of a Hong Kong university on a pilot basis for a period of two years

(iv) enhancing the Technology Talent Admission Scheme by lifting the requirement for technology firms to employ additional local employees while admitting talents outside Hong Kong

(v) extending the limit of stay of employment visas so that talents admitted under the existing and newly launched talent admission schemes and securing employment may be issued with an employment visa which will be valid for a maximum period of three years

(d) allowed eligible incoming talents to, upon becoming permanent residents, apply for a refund of the extra stamp duty paid for purchasing residential property in Hong Kong.

Eligible talents who purchase a residential property in Hong Kong, and subsequently become a permanent resident upon residing in Hong Kong for seven years, can apply for a refund of the Buyer's Stamp Duty and the New Residential Stamp Duty paid for the first residential property purchased which they still own, while the Ad Valorem Stamp Duty at Scale 2 rates is still payable such that the overall stamp duty charged will be on par with that charged on first-time home buyers who are ordinary permanent residents. The arrangement applies to any sale and purchase agreement entered from 19 October 2022 and thereafter.

Video

A Dedicated Team for Attracting Businesses and Talents has been set up. The team will proactively reach out to target enterprises and talents, liaise with universities and promote related schemes.